Mixed income earners, who balance both freelance work and traditional employment, face unique challenges when it comes to tax filing. In this guide, we’ll break down the complexities and provide clear steps to help you manage Tax Filing for Mixed Income Earners with confidence and ease.

Understanding Tax Filing for Mixed Income Earner: Freelancer and Employee

Mixed income earners, who juggle freelance gigs and employee roles, face unique tax challenges. We’ll unravel these complexities and empower you to file with confidence.

Why Tax Filing Matters:

Timely and accurate tax filing ensures compliance with the law and optimizes financial outcomes. Understanding the intricacies of tax filing for mixed income earners is key to minimizing liabilities and maximizing returns.

How to Navigate Tax Filing for mixed income earners

- Record Keeping: Maintain meticulous records of income and expenses from both freelance work and employment.

- Maximize Deductions and Credits: Explore deductions and credits available for mixed income earners to lower your tax bill.

- Professional Assistance: Seek guidance from tax professionals or utilize software to ensure accuracy and compliance. Download our FREE Freelancers DIY BIR Registration and BIR Tax Compliance Guide, utilize our Freelancer Income Tax Calculator, and/or book your Free Tax Consultation Call with us.

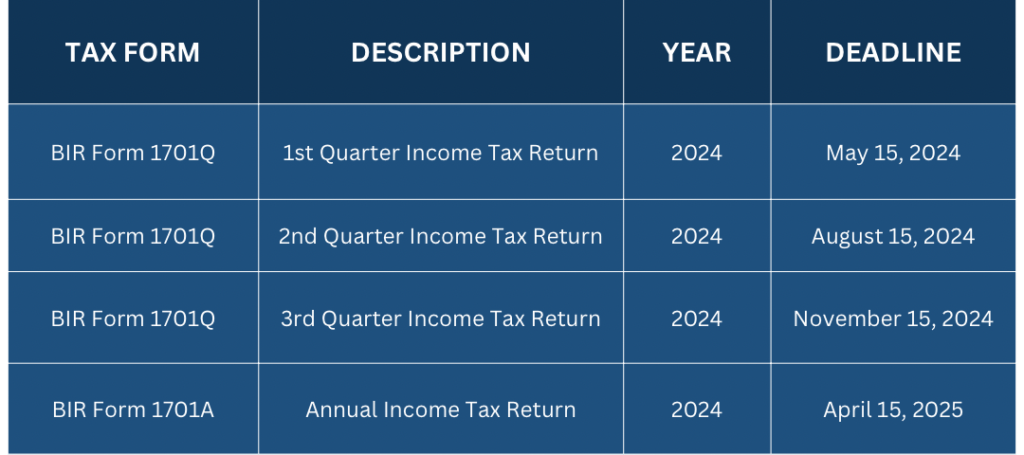

- Tax Forms and Deadlines:

Benefits of Proper Tax Filing:

Accurate tax filing yields numerous advantages, including:

- Avoidance of penalties for non-compliance

- Reduction of tax liabilities through deductions and credits

- Establishment of legal compliance and financial peace of mind

Mastering Tax Filing for Mixed Income Earners

Navigating tax filing as a mixed income earner—juggling freelance endeavors and employee responsibilities—demands attention to detail and strategic planning. By understanding the process, leveraging available resources, and seeking professional guidance when necessary, you can confidently tackle tax season and optimize your financial well-being.

Ready to take control of your taxes and boost your financial confidence?

Follow us on our socials for professional tips, updates, and exclusive content to empower your financial journey. Don’t miss out—join our community today! You can also use our Freelancer Income Tax Calculator, designed for both freelancers and mixed-income earner freelancers, to simplify your tax compliance.