For freelancers and business owners in the Philippines, proper bookkeeping is crucial for tax compliance. One essential requirement is the registration of Books of Accounts with the Bureau of Internal Revenue (BIR). Missing this step can lead to penalties, so knowing the registration deadline is important.

When Should You Register Your Books of Accounts?

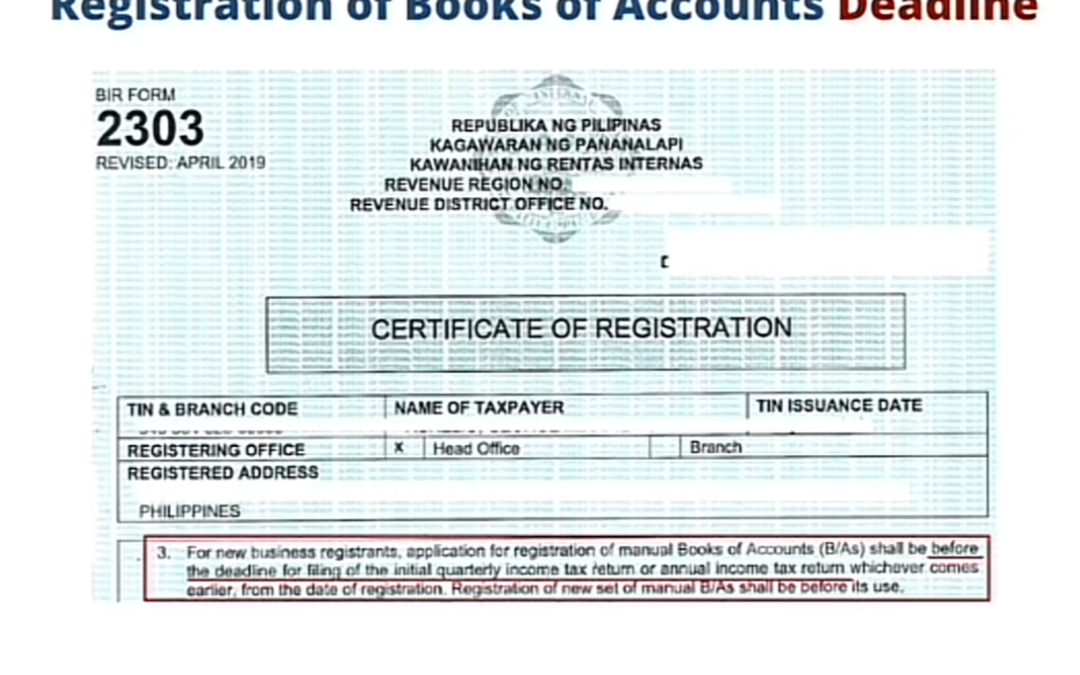

According to the BIR Certificate of Registration (Form 2303), new business registrants must apply for registration of manual Books of Accounts (B/As) before the deadline for filing their initial quarterly or annual income tax return, whichever comes first. This means that as soon as you receive your BIR Certificate of Registration, you should prioritize this process.

Additionally, if you are registering a new set of manual books, you must complete the registration before using them to ensure compliance.

Why Is Book Registration Important?

- Ensures compliance with the BIR tax requirements

- Helps in proper tracking of income and expenses

- Avoids penalties and legal issues

- Serves as a valid record in case of audits

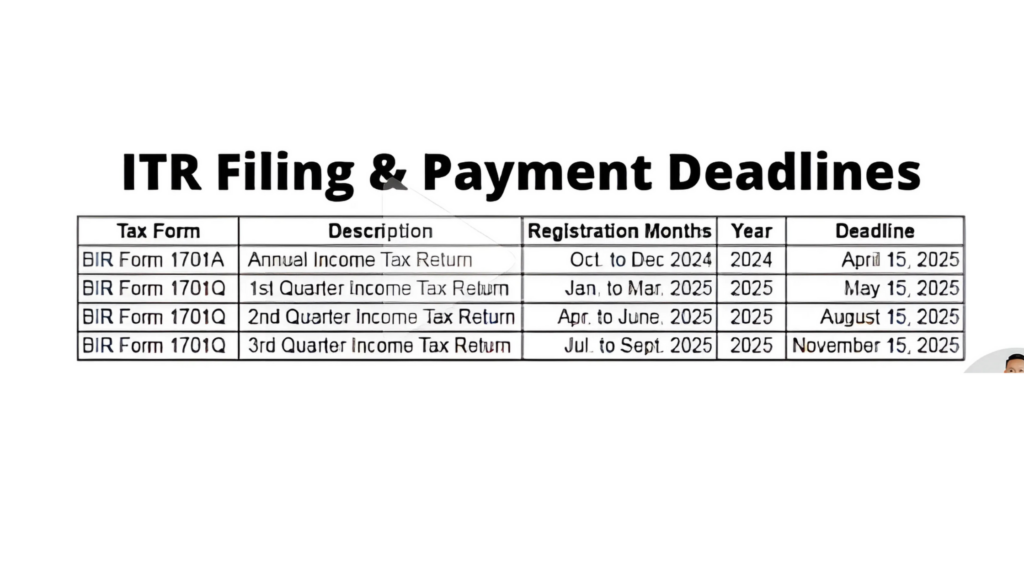

ITR Filing & Payment Deadlines

Aside from bookkeeping, business owners and self-employed individuals must also be aware of income tax return (ITR) filing deadlines. Here’s a quick overview of key ITR deadlines:

Take Action: Register Your Books of Accounts on Time!

To avoid compliance issues and unnecessary penalties, register your Books of Accounts before the deadline. Keep track of tax deadlines to maintain smooth business operations. If you’re unsure about the process, consider seeking guidance from a tax professional to ensure you’re on the right track.

Stay updated on tax compliance and financial strategies! Follow us on our socials (TikTok, YouTube, Facebook, and Instagram) and read our blogs