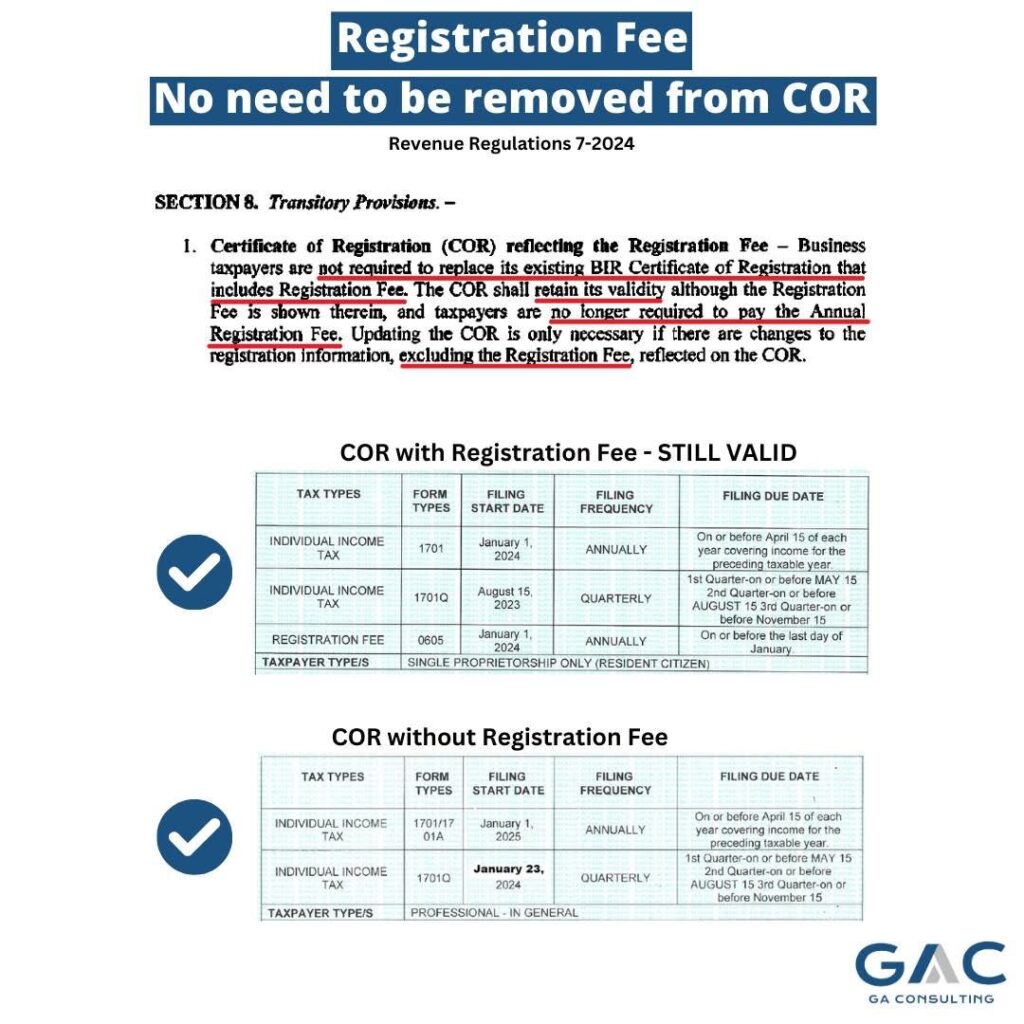

As we kick off the year, it’s essential to stay updated on any changes in tax regulations. Freelancers and business taxpayers in the Philippines, here’s a crucial update you need to know: the Bureau of Internal Revenue (BIR) has officially removed the ₱500 annual registration fee. This update directly impacts the Certificate of Registration (COR) and how taxpayers should manage it moving forward.

📍 No More ₱500 BIR Annual Registration Fee

The ₱500 fee, which was previously required for maintaining your BIR registration, is no longer necessary. This means less hassle for freelancers and small business owners, as you no longer have to worry about paying it every year.

✅ COR with Registration Fee Remains Valid

If your COR still includes the ₱500 fee, there’s no need to update it. The BIR has confirmed that your COR remains valid, even with the fee shown. There is no requirement to replace or update the COR unless other details, such as business address or activities, change.

📝 A Credible Source for Your Reference

Key Takeaways

To recap:

- The ₱500 annual registration fee is no longer required.

- Your COR remains valid with or without the fee.

- No need to update your COR unless there are other changes.

This update simplifies your tax compliance as a freelancer, so you can focus on growing your business.

Stay ahead of tax changes and freelancing updates!

Stay updated with the latest news—follow us on TikTok, YouTube, Facebook, and Instagram. Explore our blogs or tips to thrive in your freelance career, and join our Freelancers BIR Tax Compliance Support Group for expert advice and resources to ensure your success!