If you’re a freelancer filing your taxes through eBIRForms, one small but important question often comes up:

“What size of bond paper should I use to print my Income Tax Return (ITR)?”

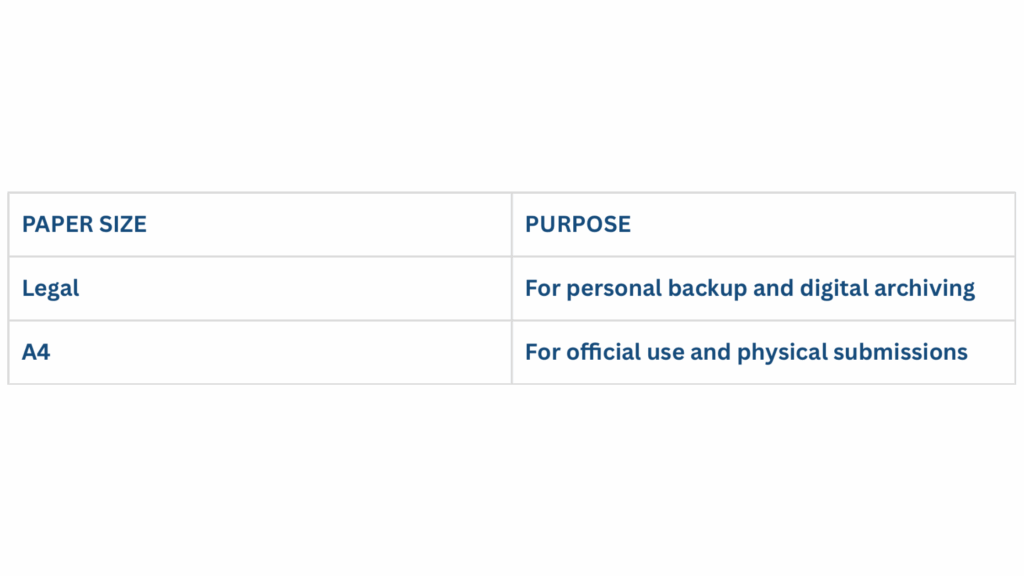

The answer? Both legal and A4—depending on the purpose.

Legal Size for Backup and Records

When you export your ITR using the eBIRForms software, it automatically formats your document in legal size (8.5 x 13 inches). This version ensures all fields are visible and no information is cut off.

📌 Why use legal size?

Because the original layout is optimized for legal paper, especially for forms like 1701A, 1701Q, or 2551Q, where full-width tables and multiple pages are involved.

✅ Use this version for:

- Your personal files

- Clear digital archiving

- Easy reference during tax audits

A4 Size for Official Use

In the Philippines, the standard paper size for official documents is A4 (8.27 x 11.69 inches).

Most offices—including banks, embassies, and even BIR Revenue District Offices—prefer or strictly require submissions printed on A4 paper.

✅ Use this version for:

- Visa applications

- Loan requirements

- Official submissions

- Requests for Certified True Copies

📌 Pro Tip:

Before printing for submission, check if the form layout still fits well in A4. Some adjustments or margins may need to be configured, especially for older versions of eBIRForms.

Why It’s Best to Keep Both Versions

Keeping both legal and A4 versions of your ITR helps you stay flexible. Whether for personal archiving or complying with specific institutional requirements, you’ll always have the correct format ready.

Also, always save a digital PDF version in a secure folder or cloud storage. This protects your file from loss and makes sharing easier when needed.

Summary

📢 Take Control of Your Tax Filing Journey

Follow us on our socials (TikTok, YouTube, Facebook, and Instagram) and read our blogs for quick, reliable tax tips made just for freelancers. Download our Ultimate DIY BIR Tax Compliance Guide, use our Freelancer Income Tax Calculator, and schedule your Free Tax Consultation Call at thegaconsulting.com.

Make your ITR filing hassle-free!