Need to retrieve your past Income Tax Return (ITR)? Whether it’s for a visa requirement, loan application, or just personal reference, accessing your previously filed ITR is easier than you think—as long as you’re using the same device you filed it on.

Here’s how to do it the right way.

Why You Can’t Access It From Another Computer

Your previously filed ITR is saved locally on the specific computer where you used the eBIRForms software. That means it’s not stored online or in any central BIR cloud system.

📌 If you switch to a different device, your records won’t appear.

That’s why it’s important to always back up your ITR files and use the same machine for consistent recordkeeping.

Step-by-Step: Accessing Your Filed ITR via eBIRForms

Here’s how you can quickly retrieve your old ITRs:

1️⃣ Open the eBIRForms software on the same computer used to file.

2️⃣ Enter your TIN (Taxpayer Identification Number).

3️⃣ Press the “Tab” key on your keyboard. This will auto-fill your saved taxpayer profile.

4️⃣ Click “Select Return” and choose the type of form you want to retrieve (e.g., 1701A, 1701Q, etc.).

5️⃣ The software will display your previous submissions for that return type.

6️⃣ From there, you can choose to print or export a PDF copy for your records.

Pro Tips for Better Recordkeeping

✅ Always save a PDF copy of your ITR right after filing.

✅ Store a backup on Google Drive or Dropbox in case you lose access to your device.

✅ Rename your files using the format: “ITR_2023_1701A_Name.pdf” for easy reference.

✅ If you switch computers, manually transfer your tax files and reinstall the eBIRForms software.

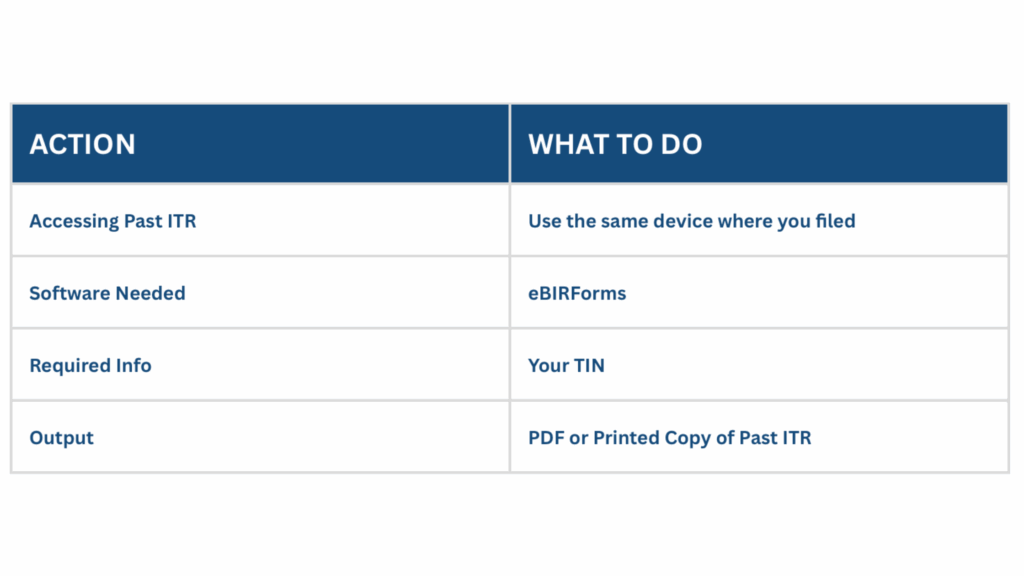

Quick Recap

📢 Make Tax Filing Easier—Every Step of the Way

Still confused about how to manage your freelancer taxes? Follow us on our socials (TikTok, YouTube, Facebook, and Instagram) and read our blogs for stress-free tax tips made just for freelancers.

Download our Ultimate DIY BIR Tax Compliance Guide, use our Freelancer Income Tax Calculator, and schedule your Free Tax Consultation Call at thegaconsulting.com.

Keep your records organized and your freelance business compliant—all year round.