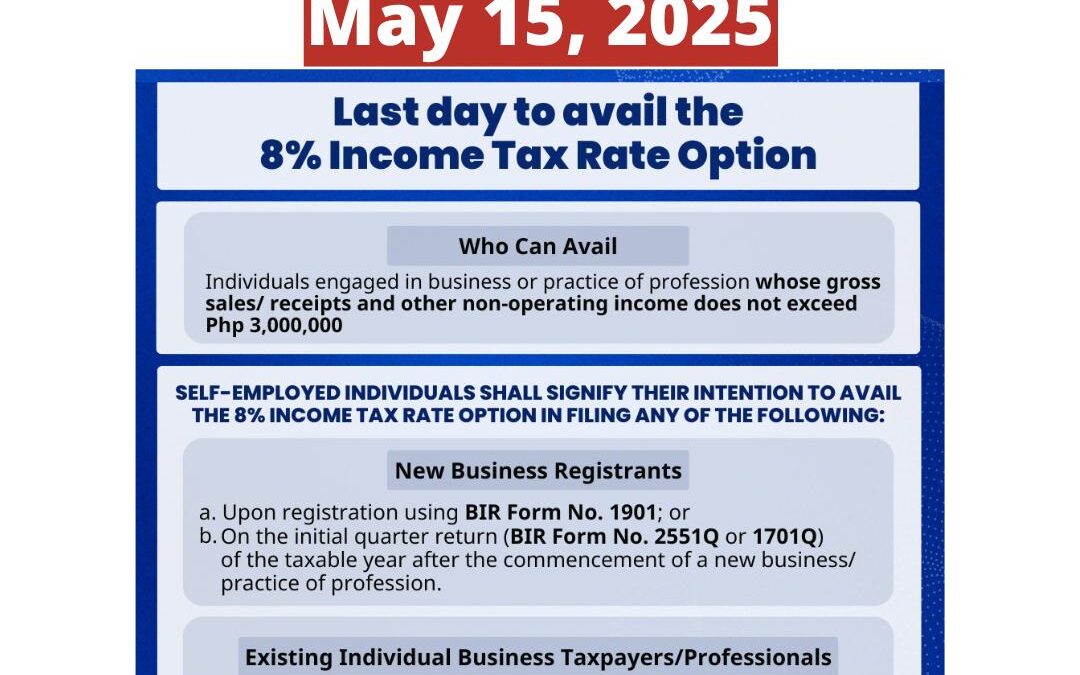

Freelancers and self-employed individuals, don’t miss your chance to opt for the 8% income tax rate—a simplified tax option designed to make tax compliance easier and lighter on your pocket! The deadline to avail this option is May 15, 2025. Here’s everything you need to know.

What is the 8% Income Tax Rate for Freelancers?

The 8% tax rate is a streamlined tax option available to freelancers and self-employed individuals in the Philippines. Instead of using the graduated income tax rates, you can opt to pay 8% of your gross sales or receipts exceeding PHP 250,000 annually.

Why Choose It?

- Simplicity: The 8% tax rate simplifies your obligations by covering both the income tax and the 3% percentage tax.

- Lower Tax Burden: For many freelancers, this option results in reduced tax payments compared to the graduated tax system.

- Ease of Compliance: With fewer forms to file and simpler calculations, tax management becomes much more convenient.

✅ Ways to Avail the 8% Income Tax Rate Option

- File BIR Form 1905 via ORUS

Use the BIR Online Registration and Update System (ORUS) to file your 1905 form online.

Guide: Click here for a step-by-step tutorial. - Choose 8% in Your 1st Quarterly ITR

Select the 8% option when filing BIR Form 1701Qv2018 for your first quarterly income tax return. - Choose 8% in Your 1st Quarterly Percentage Tax

Opt for the 8% rate when filing BIR Form 2551Qv2018, your first quarterly percentage tax return.

🔴 How to Create Your BIR ORUS Account

No ORUS account yet? If you have an existing TIN, setting it up is easy! Watch this tutorial:

Video Guide

📜 Reference

For further details, refer to:

- BIR RMC No. 50-2018

- BIR RMO No. 23-2018

Last Chance to Simplify Your Taxes

The 8% income tax rate option is a game-changer for freelancers, offering simplicity, ease, and savings. Act now and meet the May 15, 2025 deadline to enjoy these benefits!

📣 Stay Informed, Stay Ahead!

Join our Freelancers BIR Tax Compliance Support Group on Facebook for expert advice and helpful resources.

Follow us on TikTok, YouTube, Facebook, and Instagram for the latest updates, and explore our blogs for freelancing tips and tax guides designed to help you succeed!