As a freelancer, staying on top of your tax obligations is crucial for financial health and compliance. Understanding the tax filing deadlines ensures you avoid penalties and maintain smooth operations. Here’s a comprehensive guide to help you navigate through the key dates and requirements.

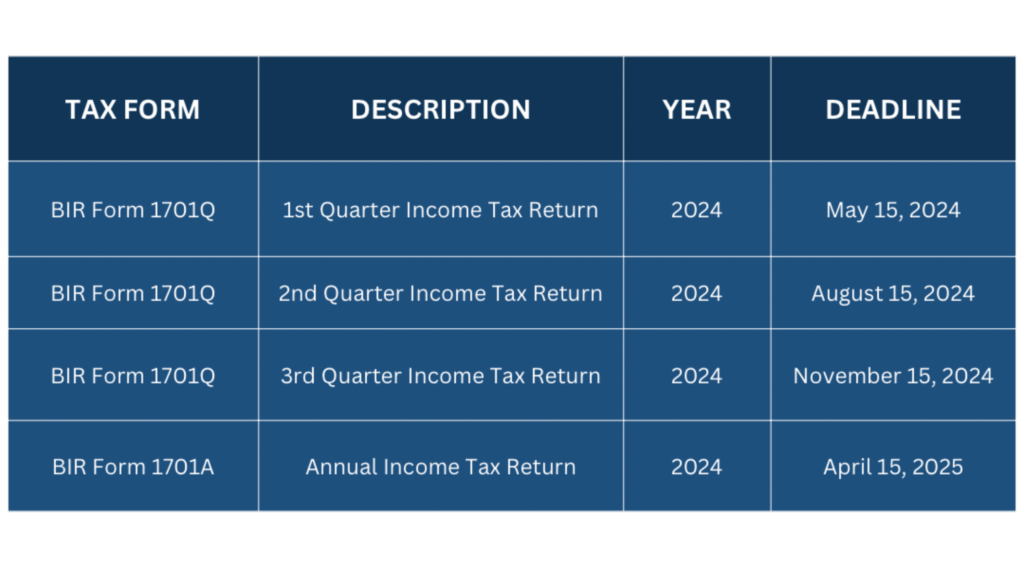

Tax Filing Deadlines

It’s crucial to mark these dates on your calendar and start preparing well in advance to avoid last-minute stress.

Meeting tax filing deadlines is crucial for avoiding penalties and legal issues. It ensures compliance with the Bureau of Internal Revenue (BIR) regulations, maintaining your good standing as a freelancer.

How to Prepare for Tax Filing Deadlines

Maintain Detailed Records:

- Keep meticulous records of income and expenses throughout the year.

- Collect and organize invoices, receipts, and financial statements.

- Regularly update your financial records to avoid last-minute stress.

Utilize Accounting Software:

- Use accounting software or apps to streamline record-keeping.

- Automate expense tracking and categorize transactions efficiently.

- Generate accurate financial reports and summaries quickly.

Organize Documents:

- Create a system for organizing tax-related documents.

- Store physical and digital copies in a secure and accessible place.

- Regularly review and update your document storage system.

Understand Tax Obligations:

- Familiarize yourself with relevant tax forms and filing requirements.

- Know the specific deadlines for quarterly and annual tax filings.

- Stay informed about changes in tax laws and regulations.

Plan for Tax Payments:

- Set aside a portion of your income for tax payments.

- Estimate your tax liability and budget accordingly.

- Consider opening a separate savings account for tax purposes.

Consult a Tax Professional:

- Seek advice from a tax professional to ensure compliance and accuracy.

- Get help with maximizing deductions and credits.

- Schedule regular check-ins with your tax advisor throughout the year.

Review Previous Returns:

- Review your previous tax returns to identify areas for improvement.

- Check for any carryforward deductions or credits.

- Learn from past filing experiences to enhance current practices.

Stay Organized and Proactive:

- Set reminders for important tax deadlines.

- Create a tax filing checklist to ensure all tasks are completed.

- Stay proactive and address any tax-related issues promptly.

Benefits of Meeting Tax Filing Deadlines

Avoid Penalties:

- Filing taxes on time prevents late fees and interest charges.

- Reduces the risk of audits and compliance issues.

Maximize Deductions and Credits:

- Timely filing allows for effective claiming of deductions and credits.

- Ensures you receive all eligible tax benefits.

Budgeting and Financial Planning:

- Helps in accurate budgeting for tax payments.

- Provides a clear picture of financial health and obligations.

Compliance with BIR Regulations:

- Ensures adherence to BIR rules and regulations.

- Avoids legal complications and potential disputes with tax authorities.

Peace of Mind:

- Reduces stress and anxiety related to tax obligations.

- Provides a sense of accomplishment and financial stability.

Improved Financial Management:

- Encourages disciplined financial record-keeping.

- Enhances overall financial management practices.

Positive Financial Reputation:

- Demonstrates financial responsibility to lenders and investors.

- Builds a positive reputation for timely compliance.

Eligibility for Loans and Grants:

- Shows financial credibility and reliability.

- Maintains eligibility for business loans and government grants.

Stay Ahead with Timely Tax Filing

Understanding and meeting tax filing deadlines is essential for every freelancer. By staying organized and informed about these key dates, you can manage your finances efficiently and focus on growing your freelance career.

Ensure Your Tax Compliance Today:

To effectively manage your taxes and stay compliant, download our FREE Freelancers DIY BIR Registration and Tax Compliance Guide, Freelancer Income Tax Calculator, and Schedule a Free Tax Consultation Call.

Stay ahead in freelancing and tax! Follow us on TikTok, YouTube, Facebook, and Instagram for exclusive tips and insights to streamline your tax process and boost your freelance success.