Navigating income tax rates is crucial for freelancers in the Philippines to ensure compliance and effective financial management. This blog explores the various types of tax rates, their criteria, differences, calculation, and how freelancers can navigate them.

What are Income Tax Rates for Freelancers?

Income tax rates for freelancers in the Philippines determine how much tax you need to pay based on your earnings. These rates vary depending on your income bracket and whether you opt for the 8% flat rate or the graduated income tax rate.

Understanding tax rates is essential for freelancers to comply with legal requirements and avoid penalties. It ensures financial stability by accurately estimating tax liabilities and managing cash flow effectively.

For freelancers in the Philippines, there are two main income tax rate options:

1. 8% Flat Rate

- Criteria: To qualify for the 8% flat rate:

- Your gross annual sales/receipts must not exceed ₱3,000,000.

- You must not be VAT-registered.

- Calculation: Total gross sales/receipts less P250,000 multiplied by 8%. Important, for mixed-income earner freelancers who opt for 8%, you cannot deduct the P250,000.

- Advantages: It simplifies tax preparation and ensures a predictable tax liability, which can be advantageous for those with relatively low expenses or deductions.

2. Graduated Income Tax

- Criteria: If your gross annual sales exceed ₱3,000,000 or you opt out of the flat rate, you will be subject to graduated income tax rate.

- Advantages: While more complex to compute, graduated tax rate allow freelancers to deduct legitimate business expenses, potentially reducing taxable income and overall tax liability.

- Calculation: Your taxable income is determined by subtracting allowable deductions (e.g., business expenses) from your gross income. The remaining amount is taxed based on progressive tax brackets.

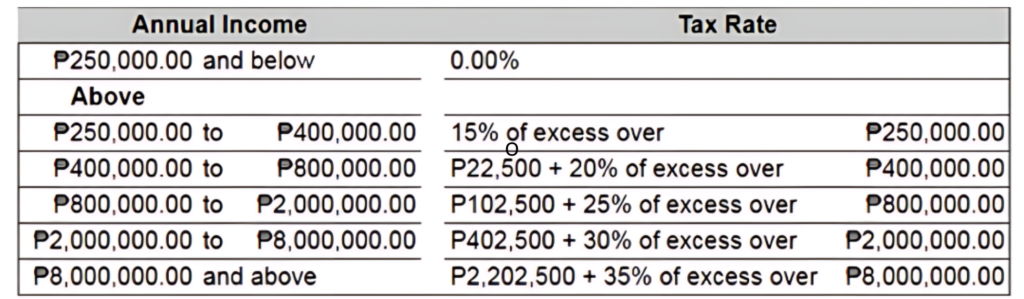

Graduated Income Tax Rate Brackets for Individuals:

Benefits of Knowing Your Tax Rates

Knowing your tax rates empowers freelancers to:

- Plan finances efficiently: By anticipating tax obligations and setting aside funds.

- Claim deductions and expenses: Maximizing deductions reduces taxable income.

- Avoid legal issues and penalties: Complying with tax regulations ensures peace of mind and avoids fines.

Mastering Tax Rates for Freelancers

Understanding the nuances of tax rates empowers freelancers to make informed financial decisions and maintain compliance with Philippine tax laws. By choosing the appropriate tax rate and adhering to filing requirements, freelancers can ensure financial stability and professional growth.

Optimize Your Tax Strategy Today

Download for FREE our Freelancers DIY BIR Registration and BIR Tax Compliance Guide, Freelancer Income Tax Calculator, and book a Free Tax Consultation Call to streamline your tax obligations as a freelancer in the Philippines. Take charge of your financial future now!